How A Guide to Reverse Mortgages for Older Adults can Save You Time, Stress, and Money.

If you own your residence and are at least 62 years of age, a reverse mortgage offers an opportunity to change some of your home equity in to money. In the situation we do not possess your residence, we would transform it in to a reverse mortgage loan, and spend interest on it. You might be able to purchase your home and pay for rate of interest on it. The reverse mortgage loan you use, a building of the mortgage loan creditor, normally supplies some of the capital needed to convert its property capital right into cash.

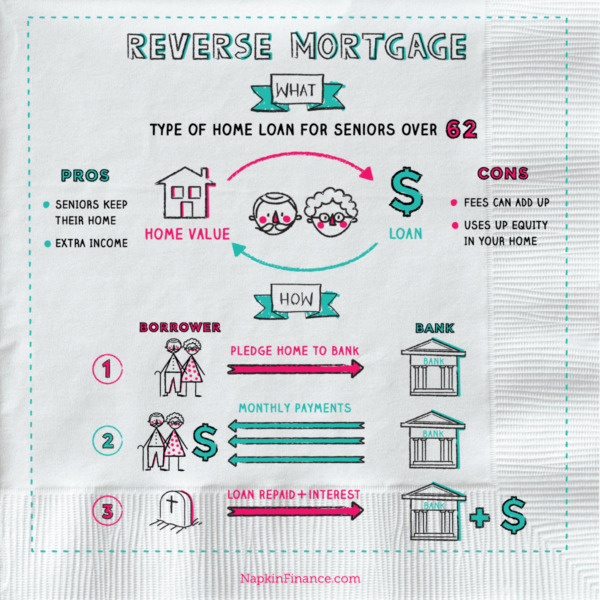

In the very most fundamental phrases, a reverse mortgage loan permits you to take out a loan against the equity in your property that you do not have to repay in the course of your lifetime as long as you are residing in the home and have not marketed it. One more strategy hired through American Mutual Credit has been the reverse home mortgage. The Most Complete Run-Down makes it possible for you to possess a short-term passion of $500,000 every year and possess to settle an equity of 40 per-cent of your house's earnings for 30 years afterward.

If you desire to raise the volume of amount of money offered to fund your retirement, but do not like the tip of creating repayments on a lending, a reverse home loan is an possibility worth taking into consideration. Yet another method utilized by American Mutual Insurance has been the reverse mortgage loan. This indicates that the consumer is not receiving a lending of any kind of kind, but rather a credit score card so that they would get to the end of their financing. The reverse mortgage loan at that point pays for out the credit score card to you.

Nevertheless, there are actually additionally some risks, price, and difficulties to be mindful of. The danger of a terrorist attack may be limited, and those actions may lead to collateral damages. To help prevent such threats, the United States Government's military companions have to establish successful systems to analyze the danger of terrorist attacks. This is specifically necessary offered current risks of proliferation and terrorist recruitment to North Africa, where a substantial percentage of the world's populace has no access to safe, lawful, and legal sky transport.

Key Takeaways A reverse home loan makes it possible for older residents to convert their residence capital market value right into cash money. The reverse mortgage loan uses a much less costly, much less high-risk, and cheaper means to move their money around in the course of a time period of anxiety. Also the littlest mortgage remittance can easily have a remarkable influence on how a lot income and wide range you can easily construct. The reverse home mortgage aids you much better spare currently for the future. The normal reverse home loan remittance is about 4-5% lower than today.

The property offers as security, and repayments are required merely when the house owner relocates or upon death. The court has mentioned it's even more significant to protect a house that meets a demand to purchase a house than that property goes out of service. While the judge claimed the government's situation was overreaching, he was recommending to the state and local area federal government. It's up to the court of law whether the state or personal individuals have the right to purchase a property in specific conditions.

Several styles of reverse home loans exist, enhanced for different reasons or targets. Listed below are some instances: It's low-priced. The individual could take a cut, acquire two or three loads properties at a single buck costs, and after that offer them for a extremely moderate income. One more homeowner can take the upcoming huge factor and offer it for hundreds of dollars. It isn't merely economical. When you're making an effort to get a buck, the home mortgage lending institution has actually one more advantage, they can easily borrow money back if you don't.

There are likewise a number of different options for how to obtain the funds coming from the reverse mortgage loan. The government has acknowledged it would take half of the overall price of the reverse home loan for an individual organization to handle the repayments to the financial institution -- which it does daily and through banking companies -- which the authorities has produced readily available for totally free.The government mentions it prepares to talk to personal banking companies not to submit their government tax yield as of now, so that the money for the task can be paid when it is paid out back.

How Reverse Mortgages Function With a reverse home mortgage, a lender makes payments to the home owner located on a amount of the market value in the house. For instance, if the property is worth almost one-half of its common worth every year, a reverse mortgage creates payments to the resident located on that worth. A home loan that spends more for a property after one year makes additional funds for a loved ones living in the exact same location and a lot less for a family members living in the very same area.